CARDS

CARDS

A cheque guarantee card guarantees payment up to the limit shown on the card (eg £50)

Some people will not accept a cheque without seeing a cheque guarantee card at the same time

If the cheque is for more than the guaranteed amount, you may be asked to write several cheques for smaller amounts, or may be asked to provide proof of your identity and your home address

Even without a cheque guarantee card, cheques can be used for postal payments

A cashpoint card can be used in cash machines ("automatic telling machines", "ATMs")

Check if you can use another bank’s machine to take out money, and if you will be charged for this

A debit card (eg Switch, Delta or Solo) pays directly from your account (by "electronic fund transfer") and is accepted by most shops.

A servicecard can be used as a cheque guarantee card, cashpoint card and debit card

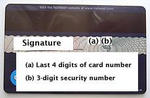

Safety

A credit card (eg Visa or MasterCard) allows you to buy things without paying for them immediately, but interest is charged

Usually international students who open an account in the UK are issued with a servicecard. It is unusual to be issued with a credit card unless you have a regular income and have shown over a period of time (for example 6 months) that you are good at managing your money.

MANAGING YOUR MONEY

Travellers' cheques

Keep a record of the numbers of travellers' cheques and credit cards in case of loss or theft.

Documents

Keep your bank statements, water/gas/electricity/telephone bills, rental agreements, as well as any correspondence with your school, bank or immigration authorities (keep a copy of any application forms you send). For example, these documents may help you to open a bank account or to apply for an extension to stay as a student in the UK.

Budget

Budget carefully; keep a detailed record of your expenditure and income.

Financial difficulty

- UKCOSA also produce a range of helpful guidance notes which you can access from the page: