What's New

TRANSFERRING MONEY FROM ABROAD

It is not safe to send/receive cash by post, because this could be easily stolen or lost.

These are some safer ways to transfer money from one country to another:

Electronic transfer of funds to your UK bank account ("sending money by wire")

Quick, but expensive

There are usually three types of transfer, depending on how quickly you need the money:

An urgent transfer (the most expensive)

A standard transfer

A relay transfer (the cheapest)

Banker’s draft

A banker’s draft is a document drawn up by the bank in your home country

You can carry this with you to the UK, or ask for them to send it to your UK address

You present the draft to your bank in the UK

If the draft is in Sterling or Dollars, it will be credited to your account quickly and there will not be a handling charge

Cheques

A slow method; cheques may take several weeks to clear

Credit card

Withdrawing money from your credit card can be expensive because of high interest charges

Traveller’s cheques

Keep a record of the numbers of traveller’s cheques and credit cards in case of loss or theft

Other international money transfer services

International money transfer services are also offered by MoneyGram or Western Union.

Compared to a bank transfer this can be a more expensive and less secure way to move money, but it is useful if the sender or receiver doesn't have a local bank account.

To make a transfer, in one country the sender pays money to a local MoneyGram or Western Union agent, shows identification, and says who will receive the money and where it will be collected. The sender is given a reference number and must tell this to the person who will receive the money. The receiver goes to the agreed location, shows identification and quotes the reference number, and can then receive the money. There are limits on how much money can be transferred in this way. It is important to make sure that you know what identification is required and that you keep your reference number private.

Exchange rates

To find the current value of 1 pound in units of your currency, click on the following link:

[ in the three boxes, choose 1, "England (UK) Pounds" (or "UK Pounds"), and your currency; then click on the "Go!" button ]![]() XE.com Personal Currency Assistant

XE.com Personal Currency Assistant

Make sure that payment by cheque is acceptable

Many shops will not accept cheques for small amounts (for example, under 10 pounds), because the shop has to pay a fixed charge to its bank for each cheque.

Many shops will not accept cheques unless you can show them a "cheque guarantee card" (you should not need this card if you are paying by post, or if the person you are paying knows you – sometimes banks do not issue cheque guarantee cards to international students)

Don’t write a cheque unless you are sure you have enough money in your account (otherwise the cheque may be returned to you by your bank, and you may have to pay a charge – in this case, we say the cheque has "bounced")

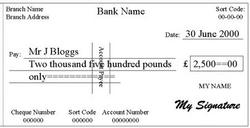

Write the name of the person or company you are paying (the ‘payee’) on the first line (top left)

Make sure that the name is clear and cannot be changed easily

For example, for a telephone bill you might write "British Telecommunications plc" instead of "BT" (if the cheque is stolen, this could easily be changed to look like somebody’s name)

If you are paying a bill, it usually tells you the full name to write (you may need to look on the back of the bill)

Write the amount being paid in words on the second line (continue on the third line, if necessary)

Write the number of pounds in words, followed by the number of pence using two numbers (eg 05 for 5 pence)

If the amount is an exact number of pounds write the word "only" instead of the number of pence

For example: £185.08 should be written "One hundred and eighty five pounds 08"

For example: £12.50 should be written "Twelve pounds 50"

For example: £2,500.00 should be written "Two thousand five hundred pounds only"

If sending the cheque by post, the words "account payee" should be be used

Normally you don’t need to write these words, as they will be printed on the cheque already

These words (or "a/c payee") should be written between the two vertical lines in the middle of the cheque

Enter the date (top right)

In the UK the order is always day-month-year (in the US, for example, the order is month-day-year)

For example, you could write "1 February 2000" or "1/2/2000"

Today’s date should normally be used, assuming you have enough money in your account

If you want to enter a future date (to "post date" the cheque), tell the person being paid

Write the amount being paid in numbers in the box (centre right)

The pound sign (£) is normally already written on the cheque

Use a comma to indicate thousands (not a dot, as used by some Europeans)

Use two parallel lines to fill the space between the number of pounds and the number of pence

(If you leave spaces, it may be possible for someone to change the words and numbers on the cheque)

Use two numbers for the pence, and 00 if it is an exact number of pounds

For example "185=08","12=50","2,500=00"

Sign the cheque (bottom right)

Use the same signature as on your cheque guarantee card

If you are paying a regular bill, write your address or customer number on the back of the cheque

For your information, copy the details on the cheque ‘stub’ (left)

If you give a cheque to someone directly, he/she may want to see your "cheque guarantee card"

The person receiving the cheque may want to write down the card number, and check that the signature on the cheque is the same as the one on the card

The bank will pay up to the amount shown on the back (often £50), even if you don’t have money in your account

If your bank has not issued you with this card, sometimes the person may not accept payment by cheque

WRITING A CHEQUE

How do you write a cheque?